Securities Fraud

Securities fraud is a crime in which laws set to protect investors and securities traders are violated. Perpetrators of securities fraud may include stockbrokers, analysts, brokerage firms, corporations, investment banks, and private investors. For example, an analyst at a brokerage firm may give a stock a favorable rating in order to secure the company's investment banking business, despite knowing that the stock is not a smart buy for investors. In another example, a private investor may commit securities fraud by acting on inside information.

Securities fraud is a serious offense that can carry both civil and criminal punishments. Criminal investigations can lead to imprisonment; in fact, the government has expressed a strong interest in increasing the length of sentences for securities fraud to ten years. In addition, the Securities and Exchange Commission (SEC) and National Association of Securities Dealers (NASD) may investigate and impose civil fines against corporations or individuals suspected of securities fraud. The SEC acts to regulate against securities fraud by enforcing investment acts and laws. If you have been charged with securities fraud, attorneys experienced in this area of law can defend your rights. Contact securities fraud lawyers in your state for legal representation.

Who Can Commit Securities Fraud?

Individuals and businesses can commit securities fraud. Lawyers can represent the party or parties who have been charged with securities fraud.

- Brokers-dealers (misleading clients or advising based on inside information)

- Financial advisors or analysts (purposefully offering poor advice or inside information)

- Corporations (hiding or distorting information)

- Private investors (acting on inside information)

Consult with securities fraud attorneys in your area for legal advice on your case.

Types of Securities Fraud

The most common forms of securities fraud that the SEC regulates against are:

- Insider trading (trading based on information that is not available to the public)

- Accounting fraud (keeping inaccurate books or presenting false information purposefully)

- Misrepresentation (presenting misleading or untrue information about a company, or its securities, to an investor or the public)

Shareholder Fraud

Shareholder fraud occurs when a company conceals its debts or beefs up its earnings reports in order to mislead investors and stockholders. Shareholder fraud can cost people their retirement funds or life savings. A few prominent examples of companies that have been accused of shareholder fraud include: Enron, Tyco, WorldCom, and Adelphia.

Investment/Brokerage Fraud

Investment and brokerage houses commit fraud when they offer false or deceptive information to their investors in an effort to manipulate the market. The SEC has set business standards for broker-dealers to follow in order to advise investors well, and handle the flow of inside information fairly. If you have been charged with securities fraud, contact attorneys in your state. Securities fraud lawyers may be able to get your case dismissed or help you obtain a lighter sentence.

Speak With an Attorney

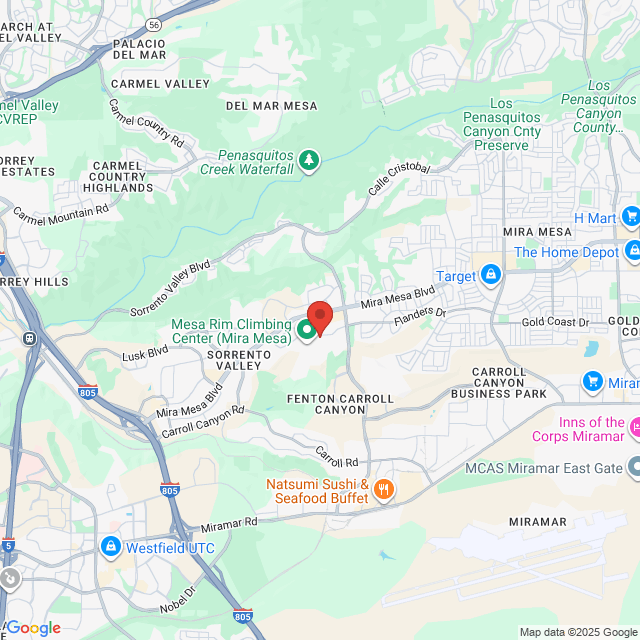

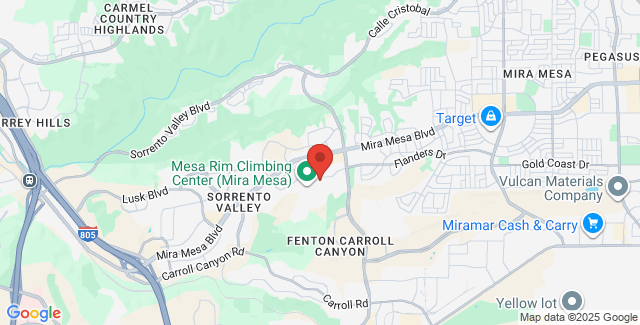

Please contact Impact Law to arrange a consultation with an attorney in your area.